Yardeni Research will be closed for the holidays until Jan. 2, 2013.

Wednesday, December 19, 2012

S&P 500 Sectors and Bull Markets

|

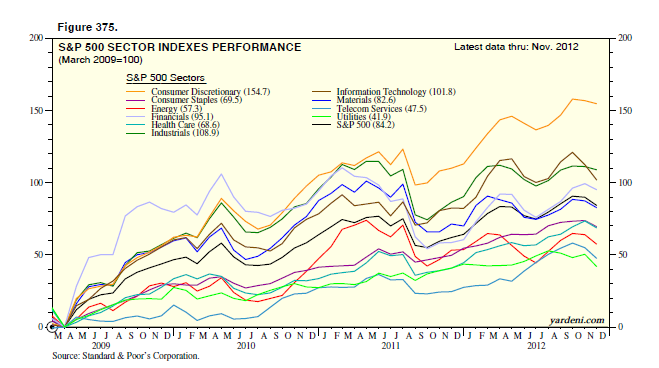

One of our accounts asked us to run some charts comparing the performances of the S&P 500 and its 10 sectors since the start of the bull market during March 2009. We used monthly data because the daily and weekly charts were too noisy. We ran similar charts for the previous bull markets starting during October 2002 and December 1994.

The charts remind us of a striking characteristic of the latest three bull markets: The best-performing sector tended to outperform all the others from the beginning through the end of the bull market. So during the bull market of the 1990s, Information Technology was the pacesetter. During the previous decade’s bull market, it was Energy. This time it has been Consumer Discretionary. While past performance is no guarantee of future results, we do expect that Consumer Discretionary may continue to outperform in 2013. Today's Morning Briefing: Three Wise Guys. (1) A quick and catchy response: "1465/1565/1665." (2) Predicting earnings of $118 per share for 2014. (3) In the “green room” with three budget pros: Bernstein, Lindsey, and Stockman. (4) Leaving the bill for the kids to pay. (5) Still gaming and blaming in DC. (6) German business confidence is up. (7) So is global oil demand. (8) Emerging economies leading the way. (9) S&P 500 sectors: And the first shall remain first. (10) Season’s Greetings and Happy New Year! (More for subscribers.) |

Tuesday, December 18, 2012

S&P 500 Valuation

|

Our Blue Angels analysis of the S&P 500 shows that its forward P/E rebounded from a recent low of 12.1 on November 15 to 12.7 yesterday. In the Santa rally scenario, it should soon retest 13, which has been an unlucky number since early 2010. The market had three nasty corrections since then after failing to rise above this valuation level.

The fourth assault on 13 could be the charm. If so, then the valuation multiple could rise quickly to 14, a level not seen since early 2010, just before Greece hit the fan. S&P 500 forward earnings edged back up to $112.77 per share during the week of December 13, just a nickel below its recent record high. A 14 multiple on that number would put the S&P 500 up to 1579, slightly above the previous record high.

The S&P 500 forward P/E is highly correlated with the Citigroup Economic Surprise Index and with the CRB metals spot price index. That’s not surprising since investors are more likely to pay higher valuation multiples for earnings when they have more confidence in the economy. Both the surprise and the metals indexes have firmed up in recent weeks. Today's Morning Briefing: Santa. (1) Looking up. (2) Nice round numbers: 1465 then 1565. (3) Barack, John, and Nick. (4) The rich will get richer. (5) Fiscal deal taking shape. (6) Devil is in the details. (7) Room for higher valuation multiple. (8) Analysts too optimistic about earnings in 2013 and 2014. (9) But there’s room for improvement. (10) Picking the leaders and laggards of 2013. (More for subscribers.) |

Monday, December 17, 2012

Revenues & Earnings

|

Stock markets discount the future. As a result, they often provide a contrarian viewpoint relative to consensus opinions, which tend to give more weight to current events and the latest data points. So, for example, recently released data for the euro area show that the region has been in a recession for the past two quarters. Yet the MSCI Europe stock price index bottomed this year on June 4 and is up 19.1% since then.

The S&P 500 is only 3.6% below its September 14 bull market high notwithstanding all the anxiety about the looming fiscal cliff. We now have Q3 data for the revenues and earnings of the S&P 500. The growth rates of both have dropped sharply, close to zero during the quarter. They certainly don’t explain why the market has been so resilient unless the outlook for both is that growth will soon turn up. That’s my forecast. Let's have a closer look at the latest data:

(1) Revenues. S&P 500 revenues per share rose 0.6% y/y during Q3, the weakest growth rate since Q3-2009, and well below the latest cyclical peak of 11.2% during Q2-2011. It is highly correlated with total US manufacturing and trade sales, which has been hovering around 3% y/y over the past five months, and remained near September’s record high during October.

(2) Earnings. S&P 500 operating earnings rose to a new record high of $25.98 per share during Q3, up 1.3% y/y. This is based on data compiled by Thomson Reuters I/B/E/S. The number in S&P's compilation edged down on a q/q basis to $24.39, falling 3.6% y/y. In any case, we are expecting that better global economic growth next year will boost the growth rates of both revenues and earnings to 5%-7% in 2013. That won’t happen if the US falls off the fiscal cliff. However, if the cliff is averted, US economic growth is likely to be surprisingly strong given that lots of pent-up demand has been building, especially in housing-related industries. Today's Morning Briefing: The End Is Not Near. (1) The world ended for the Mayans many moons ago. (2) Will Dec. 21 be a Day of Infamy? (3) A fourth year of living dangerously? (4) Stock markets aren’t buying the Mayan scenario. (5) Bulls are running in Shanghai and Tokyo. (6) New leaders in China and Japan. (7) No recession in MSCI Europe. No cliff in US stocks. (8) Revenues and earnings should start growing again in 2013. (9) Emerging economies leading the way in globalization. (10) Dr. Ed’s Movie Reviews 2012. (More for subscribers.) |

Friday, December 14, 2012

Thursday, December 13, 2012

US Federal Spending

|

The good news is that federal government spending has actually flattened out around $3.5 trillion at an annual rate since mid-2009. But that follows a big jump during the previous two years. Let’s have a closer look at the major spending categories:

(1) Income security and Medicaid. Much of the jump and subsequent flattening of federal spending was attributable to spending on “income security” programs such as unemployment benefits and food stamps. On a 12-month basis, this outlay peaked at a record $626 billion during November 2010 and fell to $557 billion last month. While this category should be counter-cyclical because it is a so-called "automatic stabilizer," it remains on a solid upward trend. Federal spending on health, i.e., mostly Medicaid, actually dipped late last year and early this year, but it too remains on an upward trend. It totaled $350 billion over the past 12 months. (2) Defense. Also edging down from last year’s record high is the 12-month pace of defense spending--from a $708 billion peak during September 2011 to $685 billion last month. (3) Social Security and Medicare. Federal spending on income support and medical care for senior citizens remains on a solid uptrend. Together they totaled a record $1.3 trillion over the past 12 months, up 85% over the past 10 years, i.e., since November 2002. (Nominal GDP rose 47% over this same period.) Spending on the health care and income security needs of low-income individuals and households who aren’t old enough to be covered by Social Security and Medicare totaled $907 billion over the past 12 months. We could balance the budget tomorrow if we kept a lid on federal spending and found roughly $1 trillion in additional revenues. Doing so by raising tax rates would crush the economy, depress revenues, and boost income support outlays. The best way to boost revenues is to stimulate economic growth. We’ve already tried to do it with a massive fiscal stimulus program during 2009 and 2010 and ultra-easy monetary policy. Here’s another idea: Let’s postpone the fiscal cliff for a year and see if the economy might grow enough all by itself to meaningfully narrow the deficit. It has done so before. Maybe it can do so again. Today's Morning Briefing: Perpetual Policies & Politics. (1) QE3 + QE4 = ?. (2) Bernanke’s open bar for fiscal drunks. (3) NZIRP now depends on unemployment rate. (4) Too much transparency? (5) The limits of unlimited QE. (6) Bernanke and Obama: Ceaseless campaigners. (7) Washington’s phony wrestling match. (8) BIS says central banks are out of control. (9) Can government spending continue to flatline? (10) Unintended consequences of entitlements. (More for subscribers.) |

Wednesday, December 12, 2012

Equity and Bond Cults

|

The bond cult is dominated by individual and institutional investors desperate to get some yield north of zero on their fixed-income investments. This is most evident in the monthly mutual fund data compiled by the Investment Company Institute. Over the past 12 months through October, net inflows into bond funds totaled $392 billion; equity funds experienced an $80 billion net outflow. Since the start of the latest bull market in stocks during March 2009, net inflows into equity funds was virtually zero, while bond funds attracted $1.25 trillion.

Nonfinancial corporations have been borrowing money from the bond cult, whose members have been desperately scrambling to lock in yields as the Fed has driven them closer to zero. Over the past four quarters, mutual funds purchased $267 billion in corporate and foreign bonds. To the extent that some of these funds have been used to buy back shares, the bond cult has been financing the bull market in stocks. This was all masterminded by the Fed’s equity and bond cults and implemented with their NZIRP and QE programs. Today's Morning Briefing: The Bond Cult. (1) Lots of corporate cash driving buybacks. (2) Corporate balance sheets are beautiful. (3) The bond cult has lent some cash to the equity cult. (4) The master plan of the Fed’s bond and equity cult. (5) Households have more net worth, including home equity. (6) Are small business owners all Republicans? (7) More job openings and online job ads. (More for subscribers.) |

Tuesday, December 11, 2012

Buybacks

Corporate treasurers have been driving the bull market in stocks, not retail and institutional investors. The Fed’s Flow of Funds data show that net issuance of corporate equities over the past year through Q3 was minus $274 billion. In other words, buybacks well exceeded gross issues. Nonfinancial corporations registered net buybacks of $419 billion, while the financial sector had net issuance of $119 billion and foreign corporations issued $25 billion, according to the Fed’s data.

The financial sector data include stock issuance by all ETFs, which rose to $174 billion over the latest four-quarter period. Excluding these ETFs, net issuance by financial corporations was minus $55 billion.

The Fed also compiles monthly data for total gross equity issuance. Over the past 12 months through October, corporations raised $152 billion. However, that was overshadowed by buybacks. Data available for the S&P 500 show that they totaled $406 billion over the past four quarters through Q2.

Today's Morning Briefing: The Equity Cult. (1) Bond King gives a eulogy. (2) Resilience of stocks proves that the cult is dead. (3) The cult’s favorite stock is down hard. (4) Cashing in before the cliff boosts capital gains tax rate. (5) Are special dividends propping up the bull? (6) Meet the real equity cult: corporate treasurers. (7) The retail investor has left the equity cult to join the bond cult. (8) The cult at the Fed. (9) The hidden strength in GDP. (10) Highly recommended new App. (More for subscribers.)

|

Monday, December 10, 2012

China

|

China’s Shanghai-Shenzhen 300 has been among the worst-performing stock markets so far this year. However, it jumped 5.0% last week on better economic news out of China. The recent strength in the price of copper was a tipoff to the rebound in Chinese industrial production growth from a recent low of 9.0% y/y during August to 10.1% during November. Retail sales rose at a better-than-expected rate of 14.9% y/y.

Last week’s rally was triggered by China’s new leaders, who spoke about the economy after the meeting of the Communist Party’s politburo. President Xi Jinping signaled a continuation of pro-growth policies and indicated he favored government support for more urbanization.

On the other hand, this morning we learn that China’s exports fell 5.1% m/m last month, while imports edged down by 0.7% (based on seasonally adjusted data). These numbers suggest that global economic growth is weak. However, keep in mind that both have been fluctuating around their record highs since the start of the year. Today's Morning Briefing: Around the World. (1) How much global growth next year? (2) Analysts cutting revenue estimates, but still see growth. (3) European stocks remain on uptrend. (4) China’s new leaders want growth. (5) Euro zone is double dipping. (6) Latest German factory orders upbeat while output is downbeat. (7) Italy and Spain are in deep recessions. (8) Brazil working on opening bottlenecks. (9) US payroll data not too bad. (10) Consumers don’t like the view. (11) Geithner has the power to adjust withholdings. (12) “Hitchcock” (+ + +). (More for subscribers.) |

Thursday, December 6, 2012

GDP vs. Nonfarm Business Output

|

Last week, I noted that real GDP on a y/y basis has been growing around 2.0%-2.5% since Q1-2010. That’s subpar. It was up 2.5% y/y during Q3. On the other hand, real output of nonfarm business was up 3.5% during Q3, and has been hovering around 3.0%-3.5% over the same period. Nearly all of the difference can be accounted for by the weakness in government spending.

That’s not a bad development from my perspective. The so-called “New Normal” is actually a combination of abnormally weak government spending on goods and services and relatively normal activity in the private sector. Remove the government (please!), and the economy looks like the Old Normal!

The growth in nonfarm business output since mid-2010 has been driven by relatively stable growth of about 2% in total hours worked in the nonfarm business sector and solid gains in productivity. That’s all good from my perspective. Today's Morning Briefing: Jettisoning the Jitters. (1) Tuning out the bad news. (2) Plenty of good news. (3) Lots of opportunities to make money around the world. (4) A happy scenario for US economy next year. (5) Rising home prices could be very stimulative. (6) Great news: Business output outpacing GDP as government growth weakens. (7) So the New Normal is the Old Normal excluding the government! (8) Record high profits and cash flow. (9) Factory orders rebounding thanks to record profits. (10) No cliff jitters in latest NM-PMI. (More for subscribers.) |

Wednesday, December 5, 2012

S&P 500 Energy & Materials

|

Among the S&P 500 sectors, Energy’s hay days were during the 1970s, when oil prices soared during the oil crises of 1973 and 1979. This sector and the Materials sector were volatile market performers during the 1980s and mostly underperformers during the 1990s, when IT massively outperformed all the other sectors, especially these two.

During the previous decade’s bull market, these two sectors significantly outperformed the others. Driving them higher both in absolute and relative terms was the perception that the emergence of the emerging economies, led by the BRICs (and especially China), set the stage for a commodities “super-cycle.” Their underperformance during the current bull market suggests that they might not be so supercharged anymore as structural debt problems around the world weigh on global economic growth. Going over the fiscal cliff would certainly weigh heavily on these two sectors next year. In any event, the prospects for global economic growth remain subdued, so they are likely to remain underperformers for a while in any case. Today Morning Briefing: Relative Performance. (1) Sorting out the patterns. (2) Consumer Discretionary stocks tend to be early cycle outperformers, but may continue to do so later this time. (3) Not too many outperformers among Consumer Staples. (4) Health Care can be a late cycle bloomer. (5) Financials should outperform, but may remain on rollercoaster in cliff scenario. (6) Energy and Materials unlikely to outperform if global growth remains weak. (7) Fracking should continue to inflate Industrial Gases and Specialty Chemicals. (8) Industrials may be market performers for a while. (9) New technologies may be commoditizing IT and weighing on sector’s stocks. (More for subscribers.) |

Tuesday, December 4, 2012

Euro Mess

|

For the past four years, a prime concern among investors was the possibility of a financial meltdown in Europe similar to the one that followed the collapse of Lehman in the US. ECB President Mario Draghi alleviated that widespread fear in late July of this year when he promised to do “whatever it takes” to defend the euro. Since then, the Europeans seem to be making some progress in cleaning up the Euro Mess.

Last week, the finance ministers of the 17 EU countries in the euro zone agreed to give Greece the next installment (€44.6 billion) of its €240 billion in rescue loans--of which the country has received about €150 billion so far. The ministers reduced the interest rate charged for the loans by 100 basis points and agreed to a 15-year extension of their maturity. The deal allows Greece to avoid an imminent default and reduces the odds of the dreaded Grexit. However, Christine Lagarde, the managing director of the IMF, warned that the Fund would not approve the next disbursement of aid to Greece unless more loans were provided for Greece to enable it to buy back its debt at a discount.

Yesterday’s FT reported that the Greek government didn’t waste any time: “Greece has launched an aggressive debt buyback programme using up to €10bn of eurozone funds, hoping it will be enough for an international deal on a wider package that secures its place in the eurozone. By paying a bigger-than-expected premium over previous market prices for Greek bonds held by private sector investors, which are trading well below their face value, Athens could retire more than €20bn of its debt mountain after costs.” The 10-year Greek government bond yield has plunged from this year’s high of 43.9% on March 8 to 14.6% this morning. Also yesterday, Spain made a formal request for about €40 billion from the euro zone's bailout fund to recapitalize its banks, well under the maximum amount of €100 billion authorized by the euro zone to recapitalize Spain’s banks. The request was approved. Today, finance ministers from all 27 EU governments will push for a deal on the setup of a new bank supervisor for the euro zone by January 1. Euro zone governments previously agreed that the creation of the supervisor must be a condition for allowing the bloc's bailout fund to pump capital directly into the region's banks. News of the Greek buyback plan helped extend last month’s rally in other euro zone “periphery” countries’ bonds. This morning, the Italian 10-year government bond yield is down to 4.40%, a two-year low. The Spanish 10-year yield is down to 5.20%, the lowest since March. The Europe FTSE Eurosfirst 300 Banks Euro Index has rallied to a new high for the year in recent days. Also encouraging is that TARGET2, the ECB’s payments system, is showing that capital stopped pouring out of Spain, Italy, and Portugal in the past few months through October. Today's Morning Briefing: Two Steps Forward. (1) The market has ADD. (2) Always something to worry about. (3) No Grexit for now. (4) Did you buy any Greek bonds at 40%? (5) Spanish banks get some rescue funds. (6) European financial indicators are upbeat. (7) TARGET2 showing less capital fright. (8) Now there are two plans to avert the fiscal cliff. (9) Let’s split the difference, and go on vacation where there are no cliffs. (10) The storm vs. the cliff. (More for subscribers.) |

Monday, December 3, 2012

Global Economy & Stock Prices

|

Our “Stay Home” investment theme outperformed the “Go Global” alternative all year until the November 6 US election results raised the odds that the US might fall off the fiscal cliff after all. The S&P 500 dropped more than overseas markets during the first half of November. The performance gap remained narrower than it had been during the rally in global stock markets during the second half of the month. The S&P 500 is up 12.6% ytd, while MSCI Europe is up 10.3% and MSCI Emerging Markets is up 9.7%.

Leading the way this year in Europe is Germany, which is up 25.6% ytd. Among the emerging economies, India’s stock market is also outpacing most of the rest with a gain of 25.1% ytd. (However, Pakistan's is up 46.1%, and the Philippines' is up 28.6%.) China is one of the worst performers this year with a drop of 8.8%, making a new low for the year last week. Yet there have been significant rallies during November in Taiwan (7.2%), Singapore (16.0%), and South Korea (5.9%). What are the markets telling us? Here are a few possibilities:

(1) Germany’s outperformance suggests that investors believe that even if Europe remains in a recession, it will be moderate. (This morning we learn that the euro zone’s M-PMI remained weak at 46.2 in November, but up from 45.5 in October.) In addition, it suggests that German companies will find enough growth globally to offset weakness in the euro zone. Meanwhile, despite all the recent commotion about Greece and Spain, Spanish and Italian government bond yields have dropped sharply in recent days, down to 5.17% and 4.39% this morning. Also impressive is that the FTSE Eurofirst 300 Banks Euro Index rose to a new high for the year last week. (2) China’s underperformance may reflect a growing perception that China’s belligerent territorial claims in the South China Sea may drive foreign direct investment, especially from Japan, elsewhere. Maybe that’s why other Asian bourses are outperforming. Until this summer, when the territorial disputes heated up, China’s stock market had tended to be highly correlated with the price of copper, which actually rallied strongly last week. China’s economy is growing, as evidenced by the surprisingly strong 20.5% y/y increase in industrial profits during October. China’s official manufacturing PMI rose to a seven-month high of 50.6 in November from 50.2 in October. (3) India’s outperformance partly reflects the government’s recent moves to reform the economy, which is showing signs of faster growth. This morning, Reuters reports, “India’s manufacturing sector beat the expectations of economists to grow at its fastest pace in five months in November, boosted by strong export orders and a surge in output, a business survey showed on Monday. The HSBC manufacturing Purchasing Managers’ Index (PMI), which gauges the business activity of India’s factories but not its utilities, rose to 53.7 in November from 52.9 in October.” Today's Morning Briefing: Aloha! (1) Hawaiian vacation. (2) Geithner offers to cut spending by $1 for $4 of taxes. (3) McConnell laughs, while Boehner cries. (4) Pelosi and Cantor both say: “We won.” (5) Cocky Dems expect GOP to cave. (6) Will Nero surf while Rome dives? (7) The market is bipolar, with more upside on deal than downside on no deal. (8) Why are Germany and India outperforming while China is underperforming? (9) Ups & downs in GDP. (10) "Silver Linings" (+). (More for subscribers.) |