|

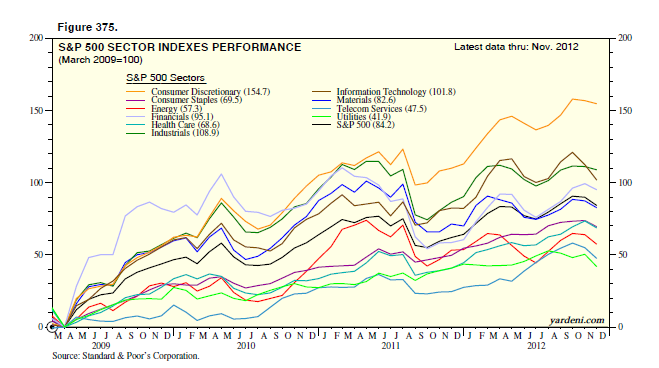

One of our accounts asked us to run some charts comparing the performances of the S&P 500 and its 10 sectors since the start of the bull market during March 2009. We used monthly data because the daily and weekly charts were too noisy. We ran similar charts for the previous bull markets starting during October 2002 and December 1994.

The charts remind us of a striking characteristic of the latest three bull markets: The best-performing sector tended to outperform all the others from the beginning through the end of the bull market. So during the bull market of the 1990s, Information Technology was the pacesetter. During the previous decade’s bull market, it was Energy. This time it has been Consumer Discretionary. While past performance is no guarantee of future results, we do expect that Consumer Discretionary may continue to outperform in 2013. Today's Morning Briefing: Three Wise Guys. (1) A quick and catchy response: "1465/1565/1665." (2) Predicting earnings of $118 per share for 2014. (3) In the “green room” with three budget pros: Bernstein, Lindsey, and Stockman. (4) Leaving the bill for the kids to pay. (5) Still gaming and blaming in DC. (6) German business confidence is up. (7) So is global oil demand. (8) Emerging economies leading the way. (9) S&P 500 sectors: And the first shall remain first. (10) Season’s Greetings and Happy New Year! (More for subscribers.) |

No comments:

Post a Comment